HAWAIIAN AIRLINES ANNOUNCES THE CHANGE OF TAX IN 2019

***For tickets issued on/after January 1, 2019:

- The U.S. International Arrival/Departure transportation tax –US- will increase to $18.60 (up from $18.30) one way.

- The US overwater (departure) tax rate for domestic segments beginning or ending in Alaska or Hawaii will increase to $9.30 (up from $9.10) one way.

- The ZP (US Segment tax) will increase to $4.20 (up from $4.10) per segment.

For tickets issued on/after December 28, 2015, the APHIS (XA) User fee will be reduced from $5.00 to $3.96 per passenger.

For Tickets issued on/after October 1, 2018, the Customs User Fee –YC- will increase from $5.65 to $5.77.

Effective July 21, 2014, major changes were made to AY (TSA Passenger Civil Aviation Security Service fee) fee application will be made.

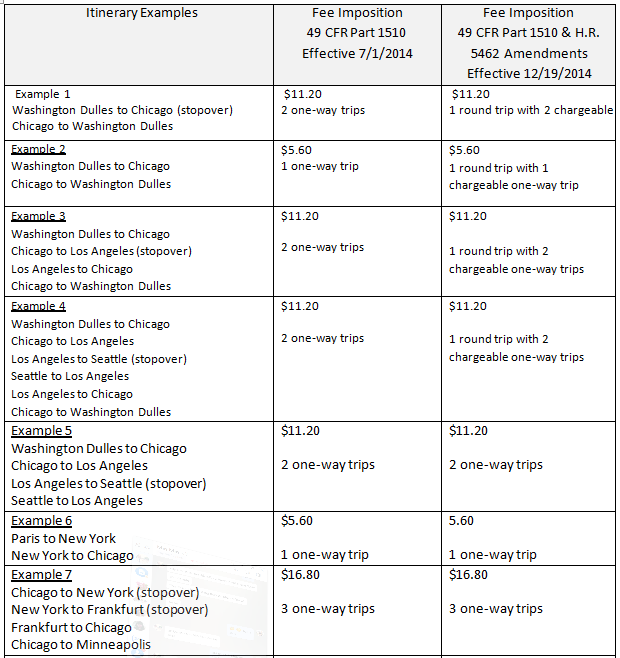

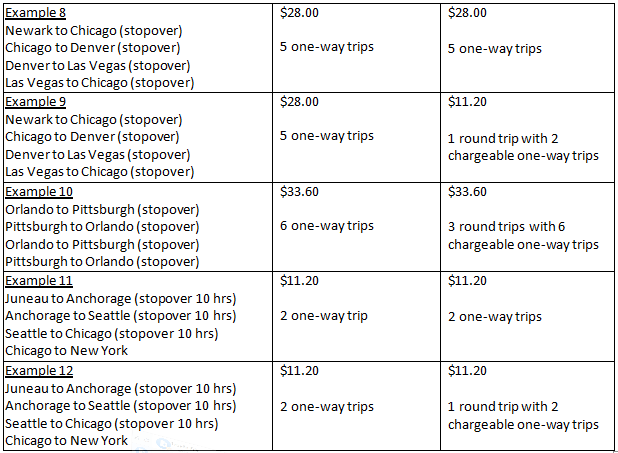

For tickets issued on/after 12:00 am midnight (Eastern Daylight Time) on July 21, 2014, the AY fee will increase to $5.60 per single one-way trip, with no cap to the amount of such fees per ticket.

A one-way trip means “continuous air transportation during which a stopover does not occur; there may be multiple one-way trips on the same air travel itinerary”. The imposition of the fee is applicable to air transportation originating at an airport in the US, regardless of where the passenger began his or her travel. Note: For these purposes one-way trip may have same point of origin and final destination provided that no stopover occurs.

For tickets issued on/after December 19, 2015, the TSA (AY) fee application became subject to a round trip fee limitation.

Limitation on Fee-

(1) AMOUNT- Fees imposed under subsection (a)(1) shall be $5.60 per one-way trip in air transportation or intrastate air transportation that originates at an airport in the United States, except that the fee imposed per round trip shall not exceed $11.20.

(2) DEFINITION OF ROUND TRIP- In this subsection, the term `round trip’ means a trip on an air travel itinerary that terminates or has a stopover at the origin point (or co-terminal).

New rules distinguish between “continental” US and “non-continental” US travel for the purpose of definition of stopovers.

- A stopover is a break in travel of more than 4 hours for “continental” US (interstate or intrastate itineraries), which involves points within the 48 contiguous states and the District of Columbia, and excludes Hawaii and Alaska.

- A stopover is a break in travel of more than 12 hours for “non-continental” US (interstate or intrastate itineraries), which includes Hawaii, Alaska, and the territories and possessions of the US.

- A stopover is a break in travel of more than 12 hours for travel between a US domestic flight and an international flight, or two international flights.

If a passenger makes changes to his/her itinerary that alters the number of one-way trips, additional collection of fee or refund of the security service fee is required as applicable. “The imposition of the fee is based on the itinerary at the time the transportation is sold”.

NOTE: For ticket exchanges on wholly unused tickets, the tax (and rules) in effect on the date of exchange shall apply. For ticket reissues on partially used tickets, the tax rates/rules in effect on the original ticket issue date will apply.

1. Applies to all tickets/coupons regardless of point of sale.

2. This fee will apply to all revenue passengers (defined as a fare value of $0.01 or more) as well as to:

- Tour Conductor Tickets/Coupons

- Frequent Flyer Awards tickets/Coupons

- Infants for whom a fee is collected

- Buy one Get one Free tickets (for both the paid and free)

- Incentive Tickets/Coupons

- DBC tickets for which a fare is collected

- All AD/ID tickets where a fee is collected

- All Buddy/Companion passes where a fee is collected such as FTP

- Claim Tickets/Coupons

- Trade Agreement Tickets/Coupons

3. Does not apply to:

- ID/AD00 (FREE) TICKETS

- Enplanements from a non-sterile area into a non-sterile area

- Promotional Tickets (not to include incentive)

- Airline employees/families who travel free of charge

- Any other free ticket/coupon where a fare is not charged with the exception of those named above.

- This fee will not apply to tickets that only the taxes and fees are issued, but the fare is zero dollars such as our employee South-pacific passes

To illustrate the changes made to TSA fee application, the TSA provided the following examples.